Colorado legislators moved forward Friday on a package of property-tax bills that would give small breaks in assessments, grant a one-time valuation cut, offer no new help to commercial building owners and set up a task force with business representation to suggest a long-term fix.

Decisions on those bills were made during the first seven hours of a special session that Gov. Jared Polis called following the rejection by voters last week of the Prop HH proposal to offer property-tax reductions in exchange for lifting the Taxpayer’s Bill of Rights state revenue cap.

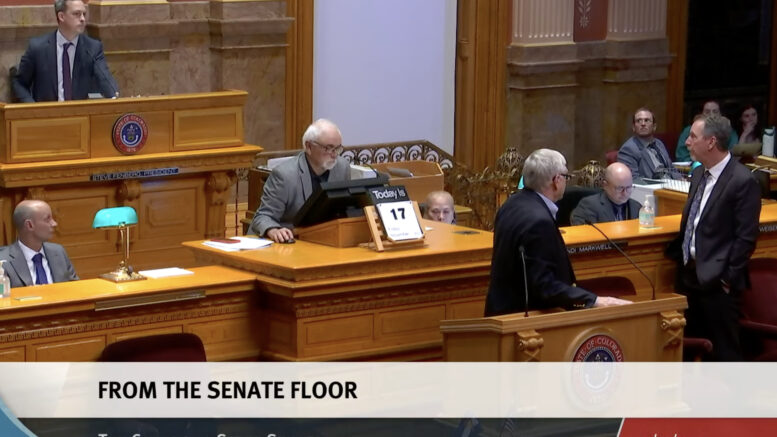

Then on Friday night, the session ground to a halt in the Senate, as Republicans successfully stalled consideration of bills for a day while arguing that Colorado residents need more time to see what legislators are offering and to be able to weigh in on the ideas. The pause, created by a procedural maneuver and leaving Senate President Steve Fenberg complaining that he was “exhausted” by the “political theater,” is likely to add at least one day onto what was expected to be a three-day session that would wrap up on Sunday, but there was no indication whether it will help Republicans achieve their goal of boosting the property-tax relief in bills.

Colorado Senate President Steve Fenberg pounds his finger on the podium in the chamber’s well Friday while compiling about what he called Republicans’ “political theater.”

Details of the bills

While both Democrats and Republicans offered plans for how to help Coloradans at a time when residential property valuations and taxes are rising by an average of more than 40% statewide, it was unsurprisingly the plans of majority Democrats that advanced on Friday. Though House Speaker Julie McCluskie, D-Dillon, opened the special session imploring representatives “to work together, not to fight each other,” Republicans began expressing frustration by mid-afternoon that their ideas were roundly rejected in partisan fashion.

The primary relief effort — Senate Bill 1, sponsored by Fenberg of Boulder and Sen. Chris Hansen of Denver, both Democrats — reduces the value of all residential properties by $50,000 for the 2023 tax year and cuts assessment rates from 6.765% to 6.7%. It also uses $172 million of the $200 million that was set aside in this year’s budget for property-tax relief to backfill revenue losses for fire districts, school districts and a limited number of local governments experiencing slow growth.

It advanced out of the Senate Finance Committee on a Democrat-led 4-3 partisan vote and awaits debate in the Senate.

A competing bill from Sen. Barbara Kirkmeyer, R-Brighton, would have generated bigger breaks, reducing home values by $80,000 and cutting assessment ratios to 6.5% while also reducing nonresidential property values $60,000 and cutting assessment rates on them from 29% to 25%. Senate Bill 4 would have backfilled local governments with $583 million — a little more than half of the revenue losses they were expected to endure — and taken the money from the state’s $2.3 billion reserve, reducing that rainy-day fund from 15% to 10.4% of the general-fund budget.

Making “lemonade”

Fenberg and Hansen said that their bill represented the most they could do within the budget allotment and that the valuation cuts would give the biggest benefits to middle-income homeowners and those on fixed budgets who would struggle most with rising tax bills. Fenberg called it a “responsible bill that provides meaningful relief” and painted it as a temporary solution while officials work on plan that can have more lasting impacts.

Colorado state Sen. Chris Hansen speaks on the Senate floor on Friday.

“We are doing our best to make lemonade here,” Hansen told the Senate Finance Committee. “I think we are taking the $200 million and stretching it as far as we can.”

Sen. Kevin Van Winkle, R-Highlands Ranch, expressed a sentiment shared by many in his party when he called the bill a “drop in the bucket” rather than an effort to provide maximum possible relief, which is what Polis told legislators he wanted from the session. Van Winkle also criticized the plan for failing to offer any relief to commercial properties.

“When a family goes shopping for groceries, they will still be hit with these property-tax increases that are built into their prices,” said Van Winkle, who also saw a committee reject his bill to cap property-tax increases at 6% for bills going out early next year.

Disagreements on size of property tax breaks

But Democrats said they could not get on board with Kirkmeyer’s plan because of what Sen. Lisa Cutter, D-Morrison, called its “irresponsible” use of state reserve funds. Sen. Julie Gonzales, D-Denver, added that while she would have considered the idea more seriously five years ago, the sudden economic crash caused by the pandemic and ongoing series of worldwide events that could produce financial panics have convinced her of the need to maintain a robust reserve.

Kirkmeyer retorted that the state could rebuild the reserves within one year and noted that over the past 40 years, the average amount the Legislature has kept in its rainy-day fund has been just 4.6%. She, as well as other Republicans, argued as well that the reserves are set aside for emergencies such as this tax-increase crisis that could cost some people their homes, but Democrats did not agree with the reasoning.

Colorado state Sen. Barbara Kirkmeyer speaks on the Senate floor earlier this year.

Legislative Democrats passed several other bills through committees on Friday afternoon that don’t affect business interests as directly as the property-tax break legislation. Those included measures to add $35 million for rental assistance, boost the state’s Earned Income Tax Credit and give each Coloradan a TABOR refund of $847 next year rather than tier refunds by income levels — a change that would increase refunds for most people making less than $104,000 and reduce them for those who are making more.

Long-term task force

The other bill that will impact businesses more directly is House Bill 1003, sponsored by Democratic Rep. Marc Snyder, D-Manitou Springs, which would set up an 18-member task force to meet from Nov. 27 through March 1 and recommend long-term property-tax fixes. Members would include six legislators and a slew of local-government representatives but also one individual representing a statewide or regional business organization and one individual with professional experience related to both commercial and residential property.

Snyder’s delegation of slots rankled a number of people, even as the bill received preliminary approval in the House.

Colorado state Rep. Stephanie Luck talks with Rep. Marc Snyder in the House well on Friday about his bill to establish a task force for long-term property-tax solutions.

Republican legislators sought to reduce the number of legislators on the panel and boost the number of everyday Coloradans. The heads of both Colorado Counties Inc. and the typically more liberal Counties & Commissioners Acting Together both requested a doubling of the two county commissioner slots on the task force. And the Colorado Real Estate Alliance said that at a time when commercial buildings face high vacancy rates and increased regulation from the state’s air-pollution division, it too needs a seat at the table.

“A long-term review of Colorado’s property-tax structure needs to include a key group of taxpayers in Colorado … commercial property owners,” said Kathie Barstnar, executive director of commercial real estate development association NAIOP Colorado, in a news release. “What is critical to understand is that the high property-tax burden on commercial building owners eventually gets passed on to their tenants, which are mostly small business owners.”

Three months to solve issues around property tax

Snyder made major changes to his bill just after introduction. He changed it from two 11-person task forces focused on local jurisdictions and economic development into one committee. He moved the committee’s start date from June to November so it could have recommendations before the end of the 2024 session. And he added money for a professional facilitator.

The goal, he emphasized, is to give committee members more than three months to deliberate potential long-term solutions rather than try to push them through in several days.

“This is a really, really challenging space to get right,” Snyder said in explaining the makeup of the proposed task force. “This is not trying to make this business-heavy or local-government-heavy or legislator-heavy.”