Supporters of Colorado’s 2021 transportation-funding law have made it clear that they don’t intend to repeal any of the fees that generated much of its opposition. But they are in the process of tweaking one requirement that’s proven especially frustrating to business owners.

Senate Bill 143, which is moving briskly through the upper chamber of the Legislature, would exempt businesses that do less than $500,000 in annual sales from having to pay the 27-cent retail delivery fee. Maybe more importantly, it would allow business owners who deliver sold goods to clients to be able to pay the fee themselves rather than add it to each transaction and itemize the fee separately on receipts.

The retail delivery fee is one of a handful of new fees central to the funding of the $5.3 billion law, including a “road-usage fee” on per-gallon gas sales, a similar fee on diesel fuel and a fee on Uber and Lyft rides. It applies to each transaction of delivery-focused companies ranging from Amazon to DoorDash, but it also must be paid by firms ranging from small businesses that deliver products to their clients to plumbing services that sell parts to customers as part of household visits.

But the retail delivery fee generated more consternation among business operators than any of the other fees — not because of the cost it added to purchases so much as because of the administrative cost of the fee, which the law requires to be paid by the customer and delineated on each receipt.

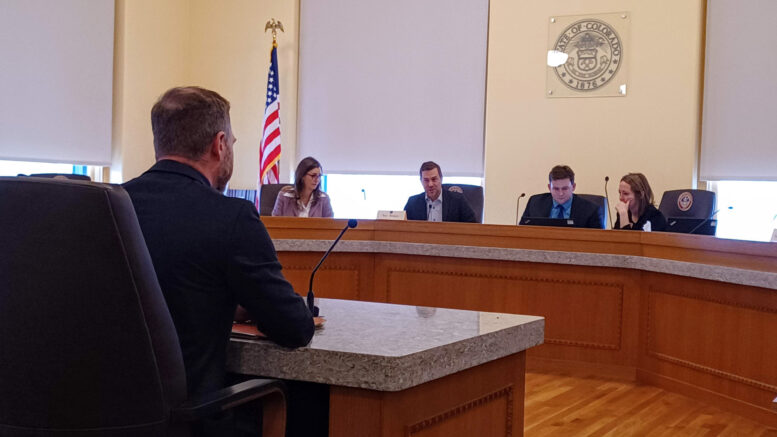

Matthew Groves, vice president of legal and regulatory affairs for the Colorado Automobile Dealers Association, noted that dealerships may deliver just five of the cars they sell each month, racking up fee costs of $1.35 a month or $16 a year that customers won’t even notice. But customizing the industry’s most common software system to add the fee separately to each delivery would cost somewhere between $2,500 and $5,000, he told the Senate Finance Committee during a Feb. 21 hearing on SB 143.

The bill — sponsored by Senate President Steve Fenberg, the Boulder Democrat who authored the 2021 funding bill, and GOP Sen. Kevin Van Winkle of Highlands Ranch, the Legislature’s foremost tax-simplification advocate — lets retailers pay the fee on behalf of purchasers. Those who do so — and that’s expected to be pretty much every retailer — will not have to add the fee to the price of delivery or itemize it separately.

“This bill is being responsive to real concerns we’ve heard,” Fenberg told the committee, which backed the bill unanimously, as did the Senate Appropriations Committee on Friday. SB 143 is scheduled for a final vote in the Senate as early as Monday and then will head to the House.

Colorado Senate President Steve Fenberg speaks at a news conference in the west foyer of the Capitol.

Laura Williams, the Colorado sales- and use-tax analyst for building-supply provider Martin Marietta, noted that even with the number of deliveries her company makes, it would cost more to reprogram its software system to add the fee as an itemized charge than the amount of fees it would remit to the state in a seven-year period. She lauded SB 143 but said that it’s just one example of the obstacles that national companies like hers must deal with to comply with state law.

“Colorado’s complex tax rules require more staff than any other state in which we do business,” Williams told the finance committee.

The nonpartisan Legislative Council found that of the 161.2 million deliveries on which the retail delivery fee on paid between July and December, 2.5 million were done by companies that earn less than $500,000 a year in sales revenue. Thus, exempting those companies from the fee likely will save those companies about $1.4 million dollars over the course of a year.

And even removal of a fee that size will help those firms, said Kelly Sloan, a lobbyist for the Westminster Chamber of Commerce.

“We strongly support the relief that this provides to the small businesses,” Sloan said. “These are the businesses that are operating on the tiniest of margins and can least support this fee.”

While the Democratic majority at the Capitol has indicated it’s willing to give this relief to business owners, it’s also shown it’s not willing to get rid of the fee. The House Transportation, Housing and Local Government Committee voted along party lines last month to kill a measure from Rep. Rose Pugliese, R-Colorado Springs, that would have eliminated the retail delivery fee after July 1.

While the Legislature moves forward on reducing the burdens of the retail delivery fee, an ongoing lawsuit seeks to nullify all the fees enacted in the bill.

Americans for Prosperity, former Republican state Sen. Jerry Sonnenberg, Advance Colorado Institute President Michael Fields and state resident Richard Orman filed the suit in April in Denver District Court, arguing that the new fees violate the Taxpayers’ Bill of Rights and a 2020-passed initiative requiring many new state enterprises to receive voter approval. The state of Colorado has filed a motion to dismiss the lawsuit, but the court has yet to rule on that request.