Colorado employers looking ahead to 2024 need to prepare for several legal and regulatory changes coming from the state government, including the full implementation of paid family leave and revisions to two rates that fund the Unemployment Insurance Trust Fund.

The changes come from a combination of new laws, a 2020 ballot initiative whose benefits are going into effect and the state’s years-long effort at stabilizing its once-bankrupt program that pays benefits to residents who have lost jobs through no fault of their own. Some of the shift for employers will involve little more than the updating of handbooks, while others will require a new way of dealing with workers who seek to take time off.

FAMLI goes live

What is “by far the most major obligation” among the new laws, according to Littler Mendelson employment-law expert David Gartenberg, is the requirement to allow partially paid leave for workers through the Family and Medical Leave Insurance program. Although employers and employees have been paying into the FAMLI fund since Jan. 1 — a total equal to 0.9% of workers’ paychecks, split evenly between employers and employees — staffers finally will be able to take advantage of the benefits beginning at the start of 2024.

The program, approved by statewide voters three years ago, permits workers to take as many as 12 weeks off over a one-year period to bond with new children, deal with their serious health issues, care for a family member or escape domestic violence. They can receive anywhere from 37% to 90% of their weekly wages, with lower-wage workers keeping a higher percentage of their earnings, and employers must preserve their job or a similar job for them upon their return if they have worked for the company at least 180 days.

Employers with state-approved private plans can approve or disapprove leave requests, but those enrolled in the state-run plan only will get notice first that a worker has applied for family leave and then that a period of leave for the employee has been approved. Because the leave can be taken in one chunk or intermittently — say, for medical appointments that occur on a recurring basis — employers must be ready to go without those workers either for a long period or many shorter periods, Gartenberg said.

David Gartenberg is a shareholder at Littler Mendelson.

“That’s going to require a lot more scheduling flexibility for employers,” he said.

Provisions of family and paid sick leave

Employees needing to take time off for unforeseen circumstances can file retrospective claims as soon as possible, but those seeking planned leave must consult with employers and make a reasonable effort to not unduly disrupt a company’s operations. Parents seeking time to bond with their children — even boys and girls who were born as long as a year before — can apply through the state’s FAMLI portal now for that leave.

Program leaders can raise the 0.9% fee to as much as 1.2% if more funding is needed to pay for claims, but Colorado Department of Labor and Employment Executive Director Joe Barela said that he expects FAMLI to be fully solvent in 2024. Once employers submit fourth-quarter payments at the end of January, the fund will have a balance of $1.4 billion — a total that is larger than expected because higher employment and wage levels have boosted the revenues coming into it.

Employers who have been required since 2021 to allow workers to earn as much as six days of paid leave during each year will have to grant that leave for a wider range of reasons in 2024 because of another one of the new laws. A law passed this year allows employees to use such leave for dealing with the death of a family member, evacuating homes during a natural disaster or caring for kids whose schools are closed for bad weather or power outages.

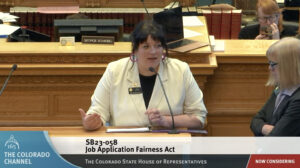

Colorado state Rep. Jenny Willford speaks about Senate Bill 58 in the House while her co-sponsor, Rep. Mary Young, looks on. Willford also sponsored the law expanding permissible uses of paid sick leave.

“I think it really brings sick-pay law out of the more traditional realm of sick-leave requirements,” Gartenberg noted.

New laws on age discrimination, unemployment fees

Also, employers no longer will be able to ask job applicants for their birthdates or for age-identifying dates like years of graduation, thanks to Senate Bill 58, which aims to ward off potential instances of age discrimination. Employers still can demand a diploma or proof of completion of certain courses or certificates, but jobseekers can redact dates from those documents if they want.

Companies also must prepare for changes in two fees they pay to support the UITF.

First, employers will begin paying a solvency surcharge this year for the first time in about a decade and are likely to have to continue paying it through 2026. The surcharge goes into place anytime the reserve ratio for the fund falls below 0.7%, meaning the reserve fund needs about $1.4 billion to be considered solvent. Heading into 2024, however, the UITF has only about $265 million, Barela told the Joint Budget Committee on Dec. 7.

Following the surge of layoffs at the start of the pandemic, the UITF went broke in August 2020, but a succession of new laws paused the solvency surcharge from 2021-23 as employers were made to pay unemployment taxes off a higher wage base and contribute more to the fund. The surcharge this year will range from .001% of a company’s wage base to .027%, depending on the employer’s experience rating.

But employers who have been paying unemployment taxes at the highest level for several years will get a break this year, moving to a lower wage schedule now that the reserves are beginning to build again, explained Abby Magnus, a senior legislative budget and policy analyst, to the JBC. The standard premium schedule for 2024 will range from .0064% to .0868%, again depending on the employer’s experience rating.