When the Public Utilities Commission begins later this summer to develop a regulatory framework for clean hydrogen projects, business and industry leaders will be watching to see how far it goes to ensure the rules allow new hydrogen production to be economically viable.

The rulemaking stems from the passage this year of House Bill 1281, which not only kickstarts the process of permitting these alternative-energy projects but offers a refundable tax credit of as much as $1 per kilogram for the use of clean hydrogen. And it comes as the state is waiting to hear back from the federal government after applying for a $1.25 billion grant to create a hydrogen hub with New Mexico, Utah and Wyoming to spur production and use of the fuel.

Gov. Jared Polis and his Colorado Energy Office view the use of hydrogen as an important way to reduce greenhouse gas emissions in sectors that are harder to electrify, including heavy-duty vehicles and industrial processes. Passage of HB 1281 is essential to the push because it will lead to regulatory certainty for companies seeking to develop the nascent fuel source and offer annual credits of as much as $1 million to users of clean hydrogen, which is expected to boost production of the energy source.

The question of hourly matching

But one provision in the law particularly has vexed industry officials — a requirement that to be eligible for the tax benefits, hydrogen must be produced by 2028 from clean-energy sources like wind or solar and that hourly production must match times when these sources are available. HB 1281 also requires any hydrogen produced by that date by investor-owned utilities like Xcel Energy and Black Hills Energy must be done under hourly-matching requirements.

Some studies have shown that such a requirement can boost the cost of production by as much as 175%. Critics say that increase in cost could push investment in hydrogen production to other states, especially because no other state requires hourly matching.

HB 1281 does not prohibit production, sale or use of hydrogen using non-renewable sources of energy. But its definition of clean energy in offering incentives is important because many other states are ramping up their own incentives in a competition for hydrogen-production plants.

In late April, the House Finance Committee added a provision to the bill delaying hourly-matching requirements until hydrogen production could be viable with them. However, sponsoring Democratic Reps. Brianna Titone of Arvada and Stephanie Vigil of Colorado Springs got it pulled out during House debate.

Colorado state Reps. Brianna Titone and Stephanie Vigil explain their bill on clean Hydrogen to the House.

Polis adds his voice

Polis then requested the PUC in a May 22 signing statement to study the matching requirement during its investigatory proceeding and, if the commission finds that it will make incentive-eligible clean-hydrogen production economically unviable, to recommend to the Legislature a new date on which the matching requirement should become law. He also noted that Colorado has asked that the U.S. Treasury not impose hourly-matching requirements for access to federal production tax credits that are set to come out later this year, meaning the state standard for incentives could be higher than the federal standard.

Nothing in Polis’ request to the PUC ensures that the commission will focus on the issue of hourly matching, that it will recommend the mandate be delayed or, even if that happens, that the Legislature will change the law in 2024. But Sarah Qureshi — senior director of government affairs for NextEra Energy Resources, which owns and operates more than 1,800 megawatts of wind-power capacity in Colorado and is looking to build more wind and solar assets to produce hydrogen here — said the statement is important because it advances discussions that began in the General Assembly.

“Signing statements don’t have the effect of law, so that’s not ideal,” Qureshi said in an interview. “But we appreciate the ability to continue that conversation with the commission.”

Years of planning for clean hydrogen

That conversation — HB 1281 requires the PUC by Sept. 1 to initiate its investigatory proceeding on issues related to projects resulting in clean-hydrogen production by investor-owned utilities — will involve concerns about both the natural environment and the business environment.

The Colorado Energy Office produced a report, “Opportunities for Low-Carbon Hydrogen in Colorado: A Roadmap,” in October 2021 that examined both the potential market for the fuel and the obstacles to its development. It noted that only 4% of global hydrogen supply was coming from low-carbon sources by 2020 and stated that hydrogen produced from renewable-energy sources likely wouldn’t achieve cost parity with hydrogen from steam methane reforming with carbon capture and storage until the mid-2030s.

Therefore, one of the policies the report listed as a key success factor for the deployment of hydrogen was to establish phased-in decarbonization and hydrogen goals. Qureshi and other industry leaders say the 2028 hourly-matching requirement is hardly phased-in, particularly because it’s unlikely that the first hydrogen-production project would be deployed in this state before 2026.

Why bill backers demand hourly matching

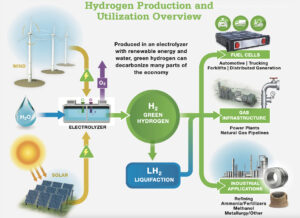

A graphic from NextEra Energy Resources explains how clean hydrogen is produced.

State Rep. Brianna Titone, an Arvada Democrat who co-sponsored HB 1281 with Democratic Rep. Stephanie Vigil of Colorado Springs, said the hourly-matching requirement was a needed piece of outreach to environmental groups who universally opposed the bill upon introduction. Because hydrogen production from non-renewable sources can result in an increase in emissions to generate a zero-emissions fuel source, it “leaves a bad taste in people’s mouths” and needs guardrails to ensure what’s being made is greener than traditional fuels, Titone said.

Part of the coming debate before the PUC will center around just how much the hourly-matching mandate will make Colorado uncompetitive for hydrogen-production facilities.

Qureshi and Riley Smith, senior manager for strategy and production solutions for NextEra, noted electrolyzers that create clean hydrogen by separating it from oxygen in water are expensive pieces of equipment that must be used constantly to generate return on investment. Limiting their use to times when the wind is blowing or when the sun is shining will drive up cost of production both by reducing their efficiency and requiring producers to build storage for the hydrogen to ensure a consistent flow to customers, Smith said.

Titone, however, said that hourly matching could still be tied to excess wind energy that is produced, especially at night, and that any disadvantages the requirement creates in attracting projects will be offset by the state’s tech-heavy labor pool and the presence of research facilities like the National Renewable Energy Laboratory in Golden. Plus, the incentives offered by other states are more lucrative than Colorado’s, meaning that if companies are choosing project locations purely based on cost, Colorado is already behind, she added.

A hydrogen hub?

“I think that Colorado is an attractive place to do hydrogen production because of the workforce and the innovation that’s here,” Titone said in an interview. “Whether it’s profitable or extremely profitable, that’s going to be the difference.”

A second issue likely will be whether the regulatory framework outlined by HB 1281 and established by the PUC will help Colorado and its partner states achieve the hydrogen-hub designation. Titone said the bill was needed was to define clean hydrogen to apply for the grant, and Qureshi said the federal cost-sharing that comes with hub status could be the deciding factor in whether utilities invest in hydrogen production — and whether companies like hers expand in Colorado to work with them.

But if the hourly-matching requirement ends up limiting the production of hydrogen in Colorado by making the final product more expensive — something the Fuel Cell and Hydrogen Association told the news site Utility Dive is likely to happen — there likely would be less interest from developers in moving forward with such work, Qureshi said. Xcel specifically is identified in the hydrogen-hub application as wanting to build a clean-energy hydrogen project on the Eastern Plains.

“The concern is: Did Colorado just unnecessarily limit itself with the hourly-matching requirement?” Qureshi asked.

More clean hydrogen producers watching

An illustration of New Day Hydrogen’s planned fuel stations, which create, store and dispense hydrogen.

Another company watching the process intently is New Day Hydrogen, a Colorado firm that is building hydrogen fueling stations and working with organizations like AAA and Xcel Energy and with third-party contractors to help fleets transition to hydrogen-based electric vehicles. Expecting to begin deploying in 2025, New Day Hydrogen CEO Seth Terry said he believes the incentives that HB 1281 offers are key to helping his company tout the financial benefits of hydrogen-fuel usage as well as the environmental and efficiency benefits for heavy-duty vehicles.

When asked about the hourly-matching requirement, Terry acknowledged that they would make operations more expensive, particularly if the company uses an electrolyzer around the clock to produce hydrogen fuel. But he said the focus for New Day Hydrogen — which has received a state grant award as it seeks further investors looking to take advantage of a 35% Advanced Industries Tax Credit — will remain most immediately on Colorado, where it hopes to build fueling stations first in North Denver and then scale hydrogen usage statewide for both commercial fleets and eventually even to passenger vehicles.

“We will adapt to whatever happens,” Terry said. “But obviously, the hourly matching makes it a bit harder of a hurdle.”