Seven years after Colorado began planning how to implement a one-stop sales-tax calculation and remittance system for retailers and three-and-a-half years after that system went live, legislators are considering five bills to make it more business-friendly.

The Sales and Use Tax System came about after legislators heard constant complaints about the state’s byzantine tax system, in which the overlap of city, county and special taxing districts creates more than 700 combinations of taxers to which retailers must remit. That became even more complicated in July 2021 when all e-tail businesses had to switch to a destination-based tax system, meaning that they must remit taxes based on the rates of the locations where customers receive their goods rather than the rate for the location where the business makes and ships them.

SUTS originally struggled to get home-rule cities to sign onto the system in which the Department of Revenue would collect taxes for them and then ship them out, but 68 of the 72 home-rule municipalities are now onboard, with two more in the process of joining. But the state has been slow to get businesses signed up — just 15,993 of the state’s nearly 700,000 registered businesses were onboard by June, said the Colorado Department of Revenue — and that means local governments likely are losing tax revenue.

Business leaders have pinpointed problems in the system, with EY partner Rachel Quintana telling a legislative committee this summer that the system takes a very long time to use and lacks integration with some major tax software programs. DOR officials have worked to address those problems and have run a campaign to alert small businesses about the nature of SUTS, but the legislative committee focused on simplifying the system recommended a handful of statute changes that could help as well.

Changes to sales-tax system

Two of those changes received unanimous approval Thursday from the House Finance Committee, despite concerns from the Colorado Municipal League about their impact on home-rule cities. Another three underwent hearings before the Senate Finance Committee on Tuesday, though the chairman delayed a vote on them in order to give municipal leaders more time to work out issues with business and state-government officials.

One of the main thrusts of the package is that legislators who have been serving on the Sales and Use Tax Simplification Task Force is trying to bring cities onto the SUTS in whatever way they can. To that end, House Bill 1041, sponsored by Democratic Rep. Cathy Kipp of Fort Collins and Republican Rep. Rick Taggart of Grand Junction, proposed to limit any municipality that is not on the system from collecting taxes from retailers that do not have a physical presence in the city, costing them valuable revenue from online sales, unless e-tailers voluntarily remit taxes.

The bill also has a carrot for small businesses, raising from $300 to $600 the amount of monthly sales- and use-tax revenue a company can generate and still be able to remit payments quarterly rather than monthly. Meghan Dollar, Colorado Chamber senior vice president of government relations, said she would like to see the department have the ability to raise that threshold even higher via rulemaking, as it will ease the administrative burden on small firms.

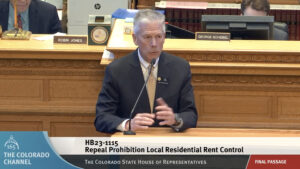

Colorado state Rep. Rick Taggart speaks on a bill on the House floor last session.

“We’re still encouraging these remaining municipalities to get on board because this is business-friendly and efficient,” Taggart said after amending the bill to strip a provision that would have forced all cities to join the system by July 2025. “And we need to be for that as a Legislature.

Lodging tax and sales-tax collections

Two other bills seek to integrate lodging taxes into the SUTS system and make the administration of statewide lodging taxes more uniform as a profusion of cities pass special taxes on short-term rentals and require them to pay fees.

Senate Bill 24, sponsored by Democratic Sen. Jeff Bridges of Greenwood Village and Republican Sen. Kevin Van Winkle of Highlands Ranch, requires cities to apply the same tax reporting and remittance standards to intermediaries like Expedia Group as they do to lodging owners reporting their taxes directly. And it bars governments from asking for more information from these intermediaries, such as guest demographics that some cities now demand, than they would ask from lodging owners.

HB 1050, sponsored by Kipp and Taggart, expands the scope of the SUTS Task Force to allow it to investigate how to integrate both local lodging taxes and local sales taxes that are included with building permits, to allow companies to determine and remit all of those taxes at one time. The patchwork of lodging fees that cities and counties require lodging providers and intermediaries to provide creates an “unsustainable burden” on those companies, and even requiring the state to put together a database listing all of those taxes by location would help, said Ashley Hodgini, head of U.S. public policy for Expedia Group.

Asked by House Finance Committee Chairman Rep. Marc Snyder, D-Manitou Springs, where Colorado ranked among states for the ease of collecting and remitting taxes, Hodgini responded: “You’re at the very bottom, I’m afraid — well, when it comes to lodging tax.”

Technical changes needed too

Colorado state Rep. Marc Snyder speaks to the Colorado Chamber of Commerce Tax Council on Feb. 2.

Acknowledging the difficulty retailers can have in figuring out exactly which governments get sales tax from shipments to each address, SB 23 seeks to hold harmless any vendor who remitted to the wrong government when using the state’s geographic information system. Local-government representatives have asked for amendments to that bill to ensure they are not liable for substantial amounts of money if they receive tax revenues in error and discover only through later audits that the money should have gone elsewhere.

And finally, SB 25 — which, like the other Senate bills is sponsored by Bridges and Van Winkle — seeks to modernize state laws governing administration of local sales or use taxes to sync up timing of tax payments, vendor fees and dispute-resolution systems, among other things. Esther van Mourik, DOR deputy director of tax policy, said she believe the changes will further induce local governments to participate in the SUTS system, which in turn will make it more likely that businesses will participate in a true one-stop system.

Snyder told the Colorado Chamber’s Tax Council on Friday that he believes the package is getting SUTS closer to being the universal system that legislators intended it to be. And while some legislators, particularly Bridges, had pushed for harsher limitations on local tax collection for cities that refused to participate in SUTS, Snyder said he thinks compromises in proposals like HB 1041 are striking the right balance.

“The bill that was introduced, they tried to use the carrot and stick approach. But it was a little too much stick and not enough carrot in my opinion,” said Snyder of a provision that would have reduced the frequency by which those cities not on SUTS could have collected taxes from businesses. “So, we took out the really punitive parts of that.”