When Colorado’s Joint Budget Committee members sit down this week to work out differences between the House and Senate versions of the 2025-26 budget, there is one highly debated proposal they won’t discuss — the disaffiliation of Pinnacol Assurance.

Gov. Jared Polis in November made conversion of the state-chartered workers’ compensation insurer into a fully privatized company one of the centerpieces of his budget plan. Not only would the proposal generate hundreds of millions of dollars for the state in the coming years to offset budget shortfalls, but such a change is needed to ensure Pinnacol’s financial sustainability, Polis and budget director Mark Ferrandino said.

But after spirited conversation with JBC members and the launch of a study to determine how much Pinnacol leaders should pay the state for their operational freedom, the idea quietly faded. As legislators the past two weeks debated details in the $44 billion budget plan ranging from transportation-funding cuts to transfers for air-quality programs, nary a word was heard about the future of the state’s largest workers’ comp insurer.

That, JBC Chairman Jeff Bridges explained in an interview, is because administration officials never finalized the proposal and never provided committee members with key details that they needed. The JBC never got a final determination of what Pinnacol would need to pay into the Public Employees’ Retirement Association pension plan as it and its workers and retirees exited PERA, and officials never offered Pinnacol leaders a final buyout price proposal.

More Pinnacol discussions to come

John O’Donnell is president and CEO of Pinnacol Assurance.

By no means is the plan dead. State officials continue to work on both of those calculations, officials close to the proposal said, and it’s very likely that a more fleshed-out proposal will resurface in 2026, the final year before Polis is termed out of office.

But Pinnacol officials — who are emphatic about the need to begin selling policies outside of Colorado, something that can happen if they disaffiliate from the state — say they need the deal to make financial sense for them as well as for the state. And without a firm offer from the state yet, they don’t know if it does, they said.

“Throughout this process, we have maintained a commitment to our core principles of financial stewardship and pricing stability for our members, capacity to provide caring protection for injured workers and an unwavering commitment to our civic leadership in Colorado,” Pinnacol President/CEO John O’Donnell said in a statement to The Sum & Substance. “These commitments remain non-negotiable as we continue to adapt and forge a pathway to provide a more seamless and modern experience for the employers and injured workers we serve.”

Polis and Pinnacol officials have noted repeatedly that the company, which once covered more than half of all Colorado employers, is losing share as more employers hire remote workers and the insurer is barred in its charter from selling policies outside the state. If large companies with interstate workforces continue to leave Pinnacol, the company will have to look to rate increases or service cuts to offset those missing revenues, officials say.

Officials need to make case for Pinnacol conversion

In order for Pinnacol to disaffiliate from the state, however, Colorado leaders must set a price for that conversion — a price that is likely to be in the hundreds of millions of dollars and include both a fee to the state and a contribution to offset PERA losses. In Polis’ proposal, all the money would go to PERA, which could invest it and begin earning returns, but the amount of the fee would be subtracted from the $225 million annual general-fund transfer to PERA over several years, giving the state some budget relief.

The state paid $80 million in 2002 to transfer its liability in the mutual insurer to Pinnacol’s policy holders and allow the company to act independently, though with state officials appointing its board and having final say over proposed charter changes. Pinnacol officials have said that, based on that price, they believe repaying the state in the range of $350 million to $400 million today would be an appropriate amount.

But the discussion about numbers hasn’t had a chance to begin yet, as the state is still working on a study to determine Pinnacol’s value, officials said. And it’s yet to determine Pinnacol’s PERA liability, Bridges said.

The other thing that has yet to happen is for advocates of disaffiliation — namely, Polis and his administration — to expand the conversation beyond the JBC to the rest of the Legislature, said Bridges, a Greenwood Village Democrat.

“Critical” discussions will continue

Joint Budget Committee Chairman Sen. Jeff Bridges speaks about the budget proposal in the Senate.

That is essential, as disaffiliation would require a bill separate from the budget proposal, and a good number of Democrats remain skeptical of how the move could affect the state’s ability to prop up a provider of last resort. Pinnacol holds that role now, responsible for selling workers’ compensation insurance to the most unsafe and risky companies that other private insurers won’t touch.

“They need to go make that case. They also need to go have tough conversations with the folks in labor,” said Bridges, noting opposition from the Colorado AFL-CIO, which fears that privatizing Pinnacol will turn its focus from helping workers to making profit. “I think Pinnacol has a strong case to make. They need to make that case. And if they can do that in a way that’s fact-based … then they will have a strong chance in the Legislature.”

Pinnacol officials said they expect the conversation around specifics of a disaffiliation plan will continue after the legislative session ends next month, so that they can have something concrete for next year. An executive with the insurer has described the need for changes to happen in the coming years as “critical.”

Without the Pinnacol discussion, legislators instead spent the past two weeks debating the ways in which JBC members proposed closing a $1.2 billion revenue shortfall, with Democrats generally supporting the plan and Republicans saying cuts didn’t go far enough. JBC members have acknowledged that with about $400 million in one-time transfers used to plug the budget gap for the coming fiscal year, more long-term structural cuts likely will be needed for the next budget, which would cover the period beginning July 2026.

Transportation funding cuts

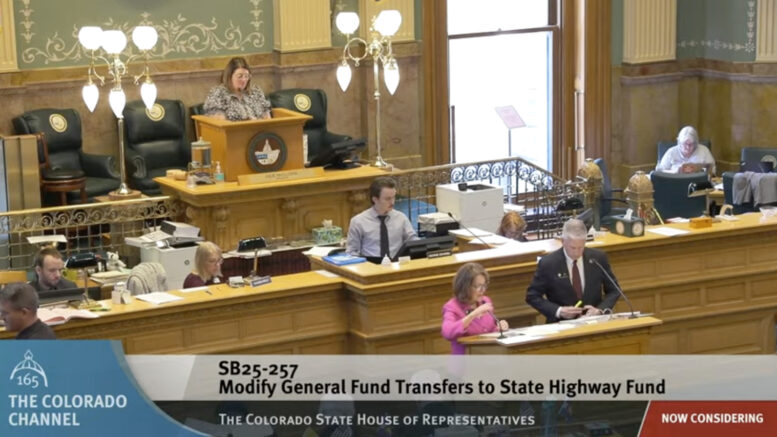

Transportation took some of the hardest hits this year — even harder than officials originally discussed when the budget was proposed in November.

The Legislature will delay about $75 million in transfers from the general fund to the State Highway Fund this year and another $56.5 million scheduled for next year, which could delay some highway expansions that haven’t yet begun. It also will reduce the road safety surcharge paid by drivers on their annual vehicle registration for the next two years, which will cut SHF revenues by $34 million in that time. And it will cut $71 million in multimodal transportation spending next year to help balance the budget.

“Seventy-five million would fill a lot of potholes,” said Rep. Mary Bradfield, R-Fountain.

Permitting efficiency in budget

Colorado state Reps. Carlos Barron and Jenny Willford offer their permitting-efficiency amendment Wednesday in the House.

In what could be considered a budgetary win for the business community, the House agreed to add an amendment Wednesday to a budget orbital bill to require state regulators to show how they are cutting permitting times with new funding they are getting. It’s common for air-quality permit applications before the Air Pollution Control Division to take more than a year to be considered, crimping the ability of industrial firms and oil-and-gas producers to do business — and slowing installation of new carbon-reducing technology.

Senate Bill 254, transfers $5 million from the general fund to the Stationary Sources Control Fund next year to help fund air-quality projects, avoiding the need to raise emissions-based fees on producers higher than officials expect to raise them in a hearing later this week. An amendment sponsored by environmentalist Democratic Rep. Jenny Willford and oil-and-gas-supporting Republican Rep. Carlos Barron requires the APCD to report to legislators on the permitting-efficiency projects it undertakes with the new funding.

“Transparency, transparency, transparency,” Barron said before the amendment passed with bipartisan backing.