Gov. Jared Polis made it official Tuesday that metropolitan districts, controversy or not, will continue to be a part of Colorado’s solution to building more housing.

The Democratic governor said in a news release that he had signed into law Senate Bill 110, which adds transparency to the governance of the special districts and places some limits on the amount of debt that metropolitan-district boards can issue. Polis announced the signing of the bill, sponsored by Democratic Sens. Janice Marchman of Loveland and Rachel Zenzinger of Arvada, without comment.

SB 110 emerged as the winner among two competing bills seeking to regulate the districts, which are responsible for much of the new-housing development in the Denver metro area and other more urbanized parts of Colorado. And it was the option among the two that developers and groups such as the Metro District Education Coalition favored.

The new law, which is set to take effect in early August, caps the amount of service-plan debt that the districts can offer at a total approved by the local government that OK’d creation of the district, requires annual in-person town-hall meetings by the districts’ boards of directors and limits interest rates on any debt to levels at or below market rates. It also requires that sellers of homes within metropolitan districts inform buyers that their home is within such a district and direct them to a website on the district’s operations.

Controversy surrounding the districts

A growing number of residents within such districts have become critical of them in recent years, saying that they were blindsided by high-cost, long-running mill levies to pay off bonds sold by the developers to install the infrastructure of new communities. Developers have responded that such debt is necessary to fund everything from roads to community centers when local governments rarely invest in infrastructure for new housing areas anymore, though they have conceded in recent years that more transparency is needed.

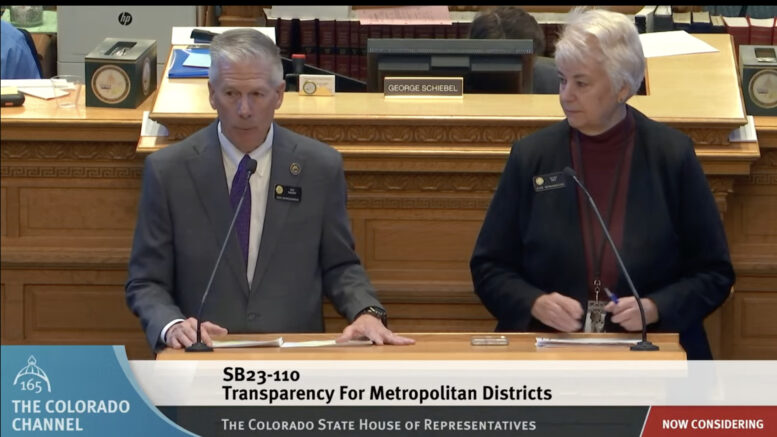

SB 110, which was sponsored in the House by Democratic Rep. Cathy Kipp of Fort Collins and Republican Rep. Rick Taggart of Grand Junction, ran largely as a countermeasure to House Bill 1090, a proposal to ban metro-district board members from purchasing any debt that districts sell on the open market. Proponents of HB 1090 argue such purchases constitute a conflict of interest that allows board members to generate profit from debt payments, while opponents said that developers who sit on such boards often must buy a portion of the debt because the bond market is not willing to fund the entire amount.

Both bills made it through the House — HB 1190 on a 38-24 vote and SB 110 on a count of 40-24 — thanks to a handful of Democratic representatives who backed each despite their seeming conflict. But while SB 110 passed the Senate on an overwhelming 29-3 margin, HB 1190 could not make it out of the Senate Local Government and Housing Committee, where it fell on a 4-3 bipartisan vote.

A push for building more homes

Zenzinger said in a statement to The Sum & Substance on Wednesday that the new law adopts the best practices that metro districts across Colorado have modeled.

Colorado state Sen. Rachel Zenzinger speaks in her chamber earlier this week.

“Collectively, these practices provide stronger local oversight, improved transparency on property taxes and mandated disclosures by developers,” Zenzinger said. “By strengthening local oversight, this legislation empowers local officials to provide sweeping protections for homeowners and homebuyers living in metro districts.”

While the bills were about the regulation of the-now 2,300 metropolitan districts across the state, they also had significant undertones in the bigger-picture housing debate at the Capitol.

Polis is pushing a land-use reform bill — SB 213, which goes for its first hearing on Thursday morning in the Senate housing committee — that would remove barriers to putting multifamily housing on many properties in urban areas that now are zoned for single-family housing. The governor has said many times that one of the keys to solving Colorado’s housing-affordability crisis is for builders to be able to produce more housing stock, which can bring down overall pricing if there are more living options for state residents to choose.