Colorado business and residential property owners will have a choice on the November ballot to reduce property-tax assessments in a way that could save them some $10 billion over 10 years but that also holds the possibility of wiping out Taxpayer’s Bill of Rights refunds forever.

Following a chaotic eight-day period that began with Gov. Jared Polis announcing his long-rumored plan to offer property-tax relief and ended with House Republicans walking out of their chamber to protest a lack of debate on that bill, legislators have put a plan in place. That sweeping plan involves reductions in property-tax assessments and rates, soft caps on property-tax growth, an offering of the same $661 TABOR refunds to every Coloradan next year and a proposal to grow the TABOR revenue cap on a 1% compounding basis for at least 10 years.

“This is a bill that, I think, meets the moment where it addresses the pain that so many business owners and homeowners will be feeling,” said Senate President Steve Fenberg, the Boulder Democrat sponsoring the bill on property-tax changes, to the Senate Appropriations Committee at a May 2 hearing.

The need for property-tax relief

That pain is the spike in property-tax assessments, averaging 30% in most Front Range counties but reaching above 50% in some parts of Colorado, that have begun hitting residents’ mailboxes in the last month. The increases represent the tremendous growth in property values between mid-2020 and mid-2022 and are so large that they threaten the ability of some homeowners on fixed incomes to remain in their properties.

Senate Bill 303, from Fenberg and Denver Democratic Sen. Chris Hansen, extends the reduced 6.7% residential assessment rates established by a 2022 law until 2032 and drops the current 27.85% nonresidential assessment rates to 26.9% through at least 2030. It also reduces the taxable value of residences $50,000 next year and $40,000 a year though 2032.

Colorado state Sen. Chris Hansen is a co-sponsor of both SB 303 and HB 1311.

Polis estimated the average homeowner will save $1,264 in property taxes over the next two years because of the bill. Meanwhile, Anneliese Steel, Colorado Concern director of public affairs, estimated that commercial properties will save 10% on what they would pay without the changes — a total decrease in property-tax bills of $3.5 billion by 2032.

The plan caps the annual rate of property-tax assessment increases going forward at the rate of inflation, through local governments can eliminate that cap if they take a vote as a body after a public hearing. Because this cap is so easily removed, Rep. Ken DeGraaf, R-Colorado Springs, said all property-tax savings estimates are overblown, as he predicted many cities, counties or special districts will seek exemptions if they feel they need money for services.

TABOR cap changes

To backfill the amount of money that the local governments will lose by not being able to collect taxes based on the full assessed value of properties, SB 303 seeks to raise the Taxpayer’s Bill of Rights cap on the revenue Colorado can collect by 1% a year through 2032, which would require voter approval on the November ballot. If the voters give their OK, that will put the Legislature in the place of being able to extend the extra revenue retention beyond the next decade if it makes a commensurate cut to other property taxes to offset this.

While 1% may not sound like much — it will allow the state to retain about $166.6 million more for the current fiscal year — Republican Rep. Rick Taggart of Grand Junction noted that number will compound annually. By 2032, the amount the state could keep would exceed $2.8 billion, negating almost any chance of it giving TABOR refunds again anytime to every taxpayer.

“This is a headlong rush into the destroying of the Taxpayer’s Bill of Rights, holding as leverage over the head of the people of Colorado the fact that property taxes are running away and will be taxing them out of their homes,” Senate Minority Leader Paul Lundeen, R-Monument, said Monday. “The most challenging and offensive part of this bill is that it tells the people ‘You must, in many ways, vote against your own self-interest if you have hope in any way of cutting your property taxes.’”

Colorado Senate Minority Leader Paul Lundeen speaks on the final day of the 2023 legislative session against Senate Bill 303.

Flat TABOR refunds

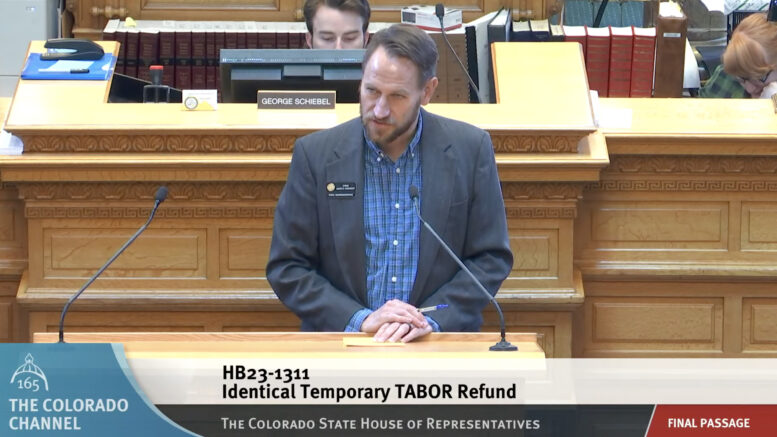

Meanwhile. a companion bill introduced on Saturday with just three days left in the legislative session would even out the TABOR refunds issued next spring, giving every resident a $661 refund through their income-tax returns rather than determining the refund based on a six-tier income system. That proposal was so rushed that its first hearing began before the bill was posted on the legislative website, and Rep. Matt Soper, R-Delta, noted he was handed a copy on his way to the hearing that was still warm from having come off the copier.

While that change would boost payments $207 for people earning $50,000 or less, it would decrease them $168 for anyone making between $157,000 and $219,000 and would drop TABOR refunds by $773 for anyone making more than $279,000 annually.

Rep. Chris deGruy Kennedy, the Lakewood Democrat sponsoring House Bill 1311 to change the TABOR refund formula temporarily, said the boost will be very impactful for lower-income Coloradans who are struggling more than wealthier residents with inflation now.

Here’s the trick, though: The flat TABOR refunds won’t kick into effect unless voters approve Proposition HH, the November ballot initiative set up by SB 303. While deGruy Kennedy said this was done to offset the help that SB 303 gives to homeowners but not to renters, Republicans like Rep. Lisa Frizell of Castle Rock said it is “grossly unfair” to allow this supposed equity-focused change only if voters agree to pass Prop HH.

Republicans cry foul over details of property-tax relief

Cities and select special districts — specifically fire, health-service, water, sanitation or library districts — will get back 100% of the property tax revenues they forego because of the new assessment-hike caps if their total property value increases by 10% or less, and they will get back 90% of losses if taxable property value increases between 10% and 20%. However, counties will get only 65% of their lost revenues back, and many of the local governments will get no backfill at all if their property-tax base grows by at least 20% — a limit that Clear Creek County Commissioner George Marlin likened to “The Hunger Games.”

An amendment introduced less than seven hours before Monday’s required adjournment of the legislative session would allow fire, health-service and ambulance districts to receive larger amounts of backfill after several complained that the proposal could force them to cut services. But that carveout led Assistant House Minority Leader Rose Pugliese, R-Colorado Springs, to accuse the sponsors of “buying votes” to ensure that vocal special districts did not campaign against Prop HH, and several Republicans launched into lengthy criticisms of the plan.

A screen capture shows the final House vote on Senate Bill 303, with 19 Republicans being marked absent after they walked out of the chamber.

When Democrats voted to cut off debate on some procedural motions that allowed the sponsors to offer the last-minute changes, all 19 House Republicans walked out of the chamber in protest, and they did not return for the remaining hours of the session. In the end, SB 303 passed the House with 39 Democrats supporting it, seven Democrats opposing it and 19 Republicans being marked absent, an unprecedented move of defiance.

After Polis signs the bills to set up the ballot initiative, supporters then must convince Colorado voters to give up increasing amounts of their TABOR refunds for help with property taxes and a larger one-time TABOR refund for lower-income residents more likely to be renters. Fiscal conservative group Advance Colorado is mulling whether to move forward with a separate ballot initiative proposing a hard 3% cap on property-tax assessment increases, setting up a potential showdown pitting Prop HH against its proposal.