Appraisers, an aging and thinning sector crucial to Colorado leaders’ goal of increasing the supply of housing statewide, will not get the regulatory relief this session that some industry leaders have said is crucial to avoiding further flight from the profession.

A Senate committee killed a bill Monday to give appraisers a five-year statute of repose — an attempt to shield them from delayed lawsuits that can jack insurance rates and cost them work with financial institutions, regardless of the outcome of the legal action. The House had passed the bipartisan bill on Feb. 12 with a bipartisan 46-18 approval, leaving hope for at least one sector to get regulatory relief at a time when state business leaders have said increasing regulations have become their No. 1 obstacle to growth.

However, Democrats on the Senate Judicial Committee said they were not convinced that there was an actual problem that the bill could solve — or that it would impact the commonly identified problem of insurance carriers dropping appraisers hit with suits. Though similar bills have passed in 14 states largely without opposition, both trial lawyers and mortgage lenders came out against House Bill 1085 in Colorado, saying that state law should not protect one sector over others during cases of foreclosure.

“I was waiting to hear testimony as to what the problem is and what problem we are trying to fix,” said Sen. Dylan Roberts, the Frisco Democrat who was viewed as the swing vote and sided with other committee Democrats against Republicans to kill the bill by a 3-2 tally. “I frankly didn’t hear of a single lawsuit today that happened more than five years after an appraisal … so I find myself confused to be honest, about the need for a bill.”

Colorado state Sen. Dylan Roberts speaks on the Senate floor earlier during the 2023 session.

Why appraisers wanted the bill

Indeed, Colorado has been home to few of the roughly 400 lawsuits nationally over the past decade alleging assessor negligence in overvaluing a home, typically one for which owners later were unable to pay mortgages. But high-priced cities such as Los Angeles and Miami that have experienced foreclosure crises during past economic downturns have had waves of legal actions there, and MJ Carroll, president of the Colorado Coalition of Appraisers, said Denver’s potentially bursting home-price bubble makes it ripe to be next.

Financial institutions hire appraisers to determine value for homes that are being sold, being parceled in divorce proceedings or being valued as part of estate planning, and their assessments weigh heavily into banks’ determinations on sizes of loans. Most lawsuits come after a home has gone into foreclosure, and many come from buyers of defaulted loans who shop for states where it’s easier to press a legal action and recoup money, said Scott DiBiasio, manager of state and industry affairs for the national Appraisal Institute.

Advocates for HB 1085 — including Republican Sen. Bob Gardner of Colorado Springs and Democratic Sen. JoAnn Ginal of Fort Collins, cosponsors of the bill in their chamber — said the extra protection for appraisers is needed because of the effects of lawsuits. They and a host of appraisers chose five years as the proposed time limit after an appraisal submission that a lawsuit could have been filed because that’s how long the Uniform Standards of Appraisal Practices require industry members to keep records.

Insurance costs, access at center of debate

Gardner told committee members that getting hit with a lawsuit can triple the cost of an errors-and-omissions insurance policy for appraisers, regardless of the outcome, but other witnesses said their insurers immediately revoked their policies if they were sued. Scott McHenry, a commercial real estate review appraiser for the Bank of Oklahoma, said that many banks also will drop an appraiser from their approved panel if they get sued.

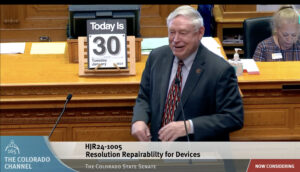

Colorado state Sen. Bob Gardner speaks on the Senate floor earlier this session.

All of this is at play while the average appraiser is in their mid-to-late 50s, and 16% of the state’s roughly 3,000 appraisers did not renew their licenses for this year, despite a need for more work from them if home construction picks up in the near future, Ginal noted. Plus, while many of the entities filing the lawsuits are national or multinational financial institutions, the average appraisal company nationwide has just 1.5 employees, meaning that the smallest businesses are left to fend for themselves, Carroll said.

“The bill is intended to provide much-needed protections to an industry that is primarily small-business owners,” Gardner said. “One lawsuit can effectively destroy a real estate appraiser.”

Mortgage lenders oppose legal help for appraisers

But Michael Flynn, an attorney specializing in mortgage-related work, said that many problems with appraisals, such as using an unnecessarily pricey set of comparable properties to establish home value, aren’t found for more than five years. And when such a problem is discovered, it affects everyone in the chain of transaction, including the lenders dealing with a default and the companies that may have bought loans from them.

Lenders can be asked to repurchase a loan at any time if defects in the appraisal are alleged, said Kimberly Woodcock, who oversees compliance and risk management for an independent mortgage bank. And when that happens, they able to sell it typically only for 50 to 80 cents on the dollar, losing money in the transaction.

The bill offered no statute of repose if there was fraud alleged in the appraisal, but Brad Groves, owner of a Denver mortgage-lending company, said that honest mistakes can be just as costly as fraud to lenders. And those arguments seemed to land better with the members of the Senate committee than they did in the House.

“If the work delivered to the lender is subpar, it doesn’t seem logical that an appraiser would be protected while the other businesses are not,” Woodcock said.

The next debates on housing

With HB 1085 dead, legislative discussion around housing returns to two primary focuses — how to increase the amount of affordable housing in urban centers throughout the state and whether to reform construction-defects laws to spur more building of condos.

The Senate Transportation, Housing and Local Government Committee is scheduled to vote Thursday on a twice-delayed bill that would provide builders a right to remedy alleged defects, with the aim of reducing the frequency and severity of lawsuits. Meanwhile, a separate bill that would roll back some existing protections for builders against lawsuits has passed its first House committee and is waiting for debate before the whole chamber.

Meanwhile, several bills are advancing that seek to ease the housing shortage in several ways, including greater allowance for building accessory dwelling units and a ban on local governments setting residential occupancy limits for unrelated tenants, which received preliminary approval in the Senate Monday. The centerpiece of that package, a bill to require local governments allow greater density of construction around transit lines, cleared its first hurdle in the House but is expected to face fiercer opposition in the Senate.