As the special session ended Tuesday, Colorado legislators sent to Gov. Jared Polis four bills that could roll back $153.2 million in business tax breaks this fiscal year, including the elimination of help for insurers with large workforces and for smaller retailers remitting their sales taxes.

Add those to a fifth bill that will let the state sell as much as $100 million worth of tax credits, and the six-day session plugged nearly one-third of the $783 million budget shortfall that the Democratic governor had hoped to fill. Polis is expected to announce roughly $250 million in proposed budget cuts later this week and then pull roughly the same amount of the $3.3 billion reserve fund to balance the budget again.

But business leaders have warned that the state could face further revenue declines because of the tax-break-rollback bills, particularly if national insurers move large number of workers to other states and if struggling small retailers close. Both business groups and Republicans complained that legislators focused all their attention in the past week on raising revenue by peeling back tax credits rather than cutting their own budget, which small businesses with shortfalls must do.

“No matter how much you couch the language, you are foisting off greater costs on businesses,” said Mark Berzins, owner of the Little Pub Company of bars and restaurants, while testifying against the proposed elimination of the vendor fee for sales-tax remittance. “At the end of the day, our tails are on the line to keep our businesses open … And you’re the ones who rely on us to create sales-tax revenues.”

Elimination of tax breaks for insurers with sizable workforces

Legislators also used the special session to extend until June 30 the enactment date for Colorado’s first-in-the-nation artificial-intelligence regulations, giving them more time to try to fix problems with the 2024 law.

The crux of sponsors’ arguments for most of the tax-break-rollback bills was that the withdrawal of the breaks will not, in their opinion, cause significant harm to affected businesses.

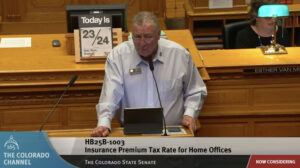

House Bill 1003, sponsored by Democratic Reps. Andy Boesenecker of Fort Collins and Javier Mabrey of Denver, would end the 66-year-old regional- and home-office tax reduction given to insurers who have at least 2.5% of their national workforce in Colorado. Those insurers can cut their 2% premium tax bill in half to 1%, and some companies said this has helped them to save more than $10 million annually and keep down premium costs.

Colorado state Rep. Andy Boesenecker explains House Bill 1003 to the House Appropriations Committee on Thursday.

Boesenecker pointed to an Office of the State Auditor report showing that between 2022 and 2024, 15 of the 18 recipients of the $72 million annual credit reduced workforce by a combined 4,300 jobs while getting $17.5 million more in tax breaks as premiums rose.

“If you would take that deal, I have a bridge to sell you across the way,” Boesenecker said, alluding to Polis’ widely panned and later scrapped idea to build a walkway from the Capitol to a park across Lincoln Avenue. “I would suggest that this tax credit isn’t working as intended.”

Tax breaks staved off further job losses, businesses say

Business and industry leaders pushed back on that idea, however, by noting that insurers who’ve moved jobs in recent years to neighboring states like Arizona or Nebraska have far greater incentives than a 50% premium tax cut to put staff elsewhere. Thus, the regional- and home-office credit has been one of the few policy perks that has offset other issues stopping employment growth in the sector and likely prevented a much greater exodus of jobs, they said.

Arizona’s cost of doing business, for example, is far lower than in Colorado, where labor costs and housing costs outpace those in neighboring states, Colorado Chamber of Commerce Senior Vice President of Governmental Affairs Meghan Dollar noted. And with its destructive wildfires and hailstorms, Colorado is the third least-profitable state for property insurers, who have lost money as a sector here in eight of the past 10 years, said Dan Jablan of the Rocky Mountain Insurance Association.

“Every time the Legislature or the Commissioner of Insurance makes a decision, it forces the C-suites of insurance companies to make a decision on where they want their workers to be,” Jablan said, adding that a legal atmosphere conducive to lawsuits also hurts.

Some legislators discussed the idea of pausing the tax credit for one year instead of eliminating it, but the plan didn’t gain enough support to earn formal introduction in either the House or Senate. Sen. Marc Snyder, D-Manitou Springs, said during debate Sunday that he wished that delay proposal would have gotten more consideration.

“What I have heartburn over is the long-term policy change we’ll be making with this bill,” said Snyder, whose county includes a substantial office for insurer USAA and who was the only member of his caucus to join all Senate Republicans in opposing the bill.

Colorado state Sen. Marc Snyder speaks about House Bill 1003 on the Senate floor.

“Incredibly profitable companies” targeted

While Boesenecker and sponsoring Sen. Mike Weissman, D-Aurora, focused on the OSA report, other HB 1003 backers hammered insurers over their profits, saying they need the money far less than recipients of state services that otherwise could be cut. Mabrey noted that auto and home insurance rates have risen more than 40% in Colorado in the past decade even as some CEOs attract multimillion-dollar salaries, and Rep. Brianna Titone, D-Arvada, questioned one insurer representative about their CEO’s pay level.

“While we are looking at cutting benefits for our most vulnerable neighbors, we should not be subsidizing incredibly profitable companies,” Mabrey told the House Appropriations Committee on Thursday.

But Sen. John Carson, R-Parker, lamented that in a state with stacked disadvantages for insurers locating here, the tax credit’s value was that it may have been the difference between keeping workers in Colorado and moving even more of them out.

“You can use all the excuses in the world about how we can make the tax code better,” Carson said during floor debate on Sunday. “But at the end of the day, it’s a 100-million-dollar tax increase, and somebody has to pay that.”

Vendor fee nixed

In addition to that tax credit, legislators targeted the longstanding vendor fee — an allowance that retailers collecting and remitting state sales taxes can keep 4% of payments for their role in gathering state funds. A half-decade ago, legislators limited the fee to companies with less than $1 million in sales per monthly filing period or $10 million in sales per year, aiming to reserve the break for smaller companies.

But with most companies today using electronic filing, calculation and submission of the fee is much easier, and state financial help no longer is needed for even smaller companies to accomplish the task, Sen. Cathy Kipp, D-Fort Collins said. So, HB 1005, which she sponsored, proposed nixing the fee to save the state $54.5 million annually— part of $315.6 million in ongoing annual savings the four tax-break rollback fees can generate.

Colorado state Sen. Cathy Kipp speaks about the bill to eliminate the vendor fee on the Senate floor.

“Every dollar we give away through an outdated vendor discount is a dollar we take away from kids in classrooms and people on Medicaid and SNAP (food-assistance) benefits,” Kipp argued.

Restaurants and smaller retailers see the change very differently, however, noting that the savings from the state helps them to pay for the software to calculate their taxes or to hire part-time bookkeepers to handle the work, as Berzins does. And this looming increase in expenses, set to start in 2026, comes as restaurants in urban areas are shuttering at higher rates due to a combination of increasing expenses and decreasing foot traffic.

Elimination of tax breaks feeds larger anti-business narrative

Colorado Restaurant Association Director of Government Affairs Nick Hoover, relaying information he’d received from one member eatery, said operational costs had risen 39% since 2023 while the restaurant only had increased menu prices by 15%. While this additional loss of as much as $1,000 per filing period may not seem backbreaking on its own, it’s part of a “death by a thousand cuts,” including rising minimum wages and credit-card swipe fees, that is leading more business owners to pull the plug, he said.

“They’re businesses, and they cannot support their teams when costs rise endlessly without relief in sight,” Hoover said.

During debate on HB 1005, Sen. Lisa Frizell noted statistics from the Colorado Chamber of Commerce’s most recent annual survey showing that 51% of respondents have slowed or reduced growth because of Colorado’s regulatory environment. And with 71% also saying that Colorado’s business climate is more costly or burdensome than other states, changes like eliminating the vendor fee are encouraging entrepreneurs to invest elsewhere, she said.

“We used to have an amazing business environment. We are not that anymore,” Frizell said during floor debate on HB 1005, which eked out of the Senate on an 18-17 vote. “There is no reason we can’t be one of those shining states from an economic standpoint — except for the regulation and overreach we in this building have imparted on our businesses.”

“Just call them giveaways”

Proponents argued, however, that House Resolution 1, the federal “One Big Beautiful Bill” that triggered the special session by boosting tax breaks and reducing state revenue this fiscal year by $1.2 billion, will benefit companies more than HB 1005 will hurt them. For example, many restaurants are registered as pass-through companies like LLCs or sole proprietorships, and the federal bill continues a 20% deduction they will receive on their overall tax bills, Bell Policy Center government-affairs director Joshua Mantell said.

“There’s lots of evidence from other states that changing or eliminating these tax breaks doesn’t have an effect on jobs or premiums or vendors or even vendor compliance,” added Kathy White, executive director of the Colorado Fiscal Institute. “They’re not effective at what they were really intended to do. If you want to call them giveaways, just call them giveaways.”

Two other bills decoupled state tax policy from federal tax policy. That allow individuals and businesses to continue to receive new or enhanced federal tax benefits but requires them to add those deductions back into their federal taxable income on which the state calculates the annual amount of income taxes they own it.

Colorado state Reps. Bob Marshall and Yara Zokaie speak in the House about their bill to change two Colorado tax laws related to foreign revenues.

State decouples from federal tax breaks as well

HB 1002 decouples state law from the federal tax break on foreign-derived deduction-eligible income, which allows businesses to take increased deductions on foreign sales related to tangible and intellectual property like patents. It also adds five countries — Hong Kong, the Republic of Ireland, Liechtenstein, the Netherlands and Singapore — to the list of state-identified tax havens for which companies must add back into their taxable operating income any tax breaks they receive from operating in those countries.

Officials expect to save $72.2 million annually in tax revenue because of HB 1002.

Legislators also approved HB 1001, which continues to decouple the federal 20% tax deduction, known as the Qualified Business Income benefit, for pass-through companies reporting at least $500,000 in revenues through a single filer. That measure, which came under fierce opposition from legislative Republicans, is expected to save the state $95.5 million annually.

Each of the bills is on their way now to Polis, who is expected to sign them quickly. Democratic legislators have said this list of tax-break rollbacks represents just their “first pass” at looking at removing more tax deductions when the 2026 legislative session convenes in January.