Colorado’s struggling film industry received a boost from Gov. Jared Polis this week that it’s sought for several years — but it’s a leg-up that is more limited than originally envisioned and may be short-lived without a legislative fix.

The Democratic governor on Monday signed House Bill 1309, which in 2024 will replace the state’s 11-year-old performance-based spending rebate for approved film, television and video-game products with a state income-tax credit for locally made productions. HB 1309, sponsored by Democratic Reps. Leslie Herod of Denver and Marc Snyder of Manitou Springs based on recommendations from a task force studying the state’s film industry, represents the first tax credit the state has granted for the industry.

However, it also represents a smaller carrot than the task force asked the state to offer, and the allocation was cut during the legislative process from a $15 million annual program lasting five years to a $5 million program lasting just one year. Not only that, but Polis noted in a signing statement that wording in HB 1309 arguably limits the state film office’s ability to administer existing rebate funds after Jan. 1 and nixes those funds in future years, which the governor asked staff and legislators to fix early in the 2024 session.

What the bill can mean for the film industry

Despite those shortcomings, the bill received bipartisan support during the closing days of an acrimonious legislative session, and the tax credit that had been sought since before the pandemic began, according to previous Denver Business Journal reporting, will be enacted next year. The tax credit is particularly appealing, sources have said, because it can be used more easily to secure financing in advance of production than the existing 20% spending rebate can be.

Herod said she expects that the funding can help the state to garner one or two larger films — though not a major television series, which would require a governmental commitment of more than one year — and add onto its recent momentum in attracting independent films. Also, she said, the fact that HB 1309 received universal Democratic support and backing of 13 of the 31 legislative Republicans when the idea formerly met bipartisan opposition should send a message to the film industry that Colorado is willing to do what it can to grow the sector here.

“We have to start somewhere, and we have been showing that we can over the past couple of years. But if we want to start building the sound stages, if we want to draw studios, we have to have an ongoing incentive,” she said in an interview. “We want to build the industry, not just because we like film but because we want those working in it to stay in Colorado.”

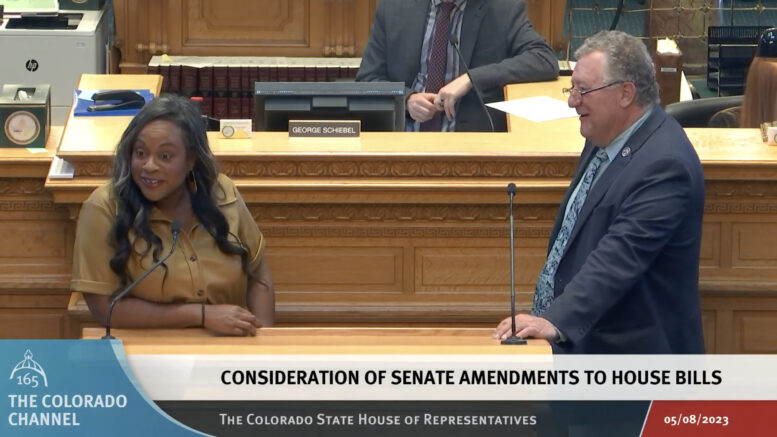

Colorado state Rep. Leslie Herod discusses her bill to boost the state’s film industry.

History of the state film incentive

Colorado launched its 20% spending rebate in 2012, but the program went through fits and starts in the subsequent years as legislators offered annual allocations ranging from $5 million down to just $750,000 and criticized a lack of accountability in the program. State leaders added $10 million to the rebate program between late 2020 and late 2022 to give it a boost through the pandemic, but the spending paled in comparison to both major film markets such as New Mexico and Georgia and to regional competitors like Utah and Montana.

A task force that met throughout the second half of 2022 recommended that the state replace the rebate with a tax credit, boost spending on the program and offer additional incentives for producers to work in rural communities or marginalized urban centers. As such, HB 1309, in addition to setting aside $5 million for tax credits, increases from 20% to 22% the amount of tax credit a company can receive on qualified expenditures if they film in underrepresented areas.

A number of industry representatives stayed past midnight on May 4 to explain to a Senate Finance Committee why the new spending is so needed.

Help sought

Ken Seagren, owner of 49-year-old motion-picture-equipment rental firm Lighting Services Inc., explained that he liquidated more than $1 million worth of equipment and closed his 15,000-square-foot soundstage in the past decade because of the decline in filming in Colorado. He wants to keep providing equipment to the industry, he said, but will have a hard time doing so if producers continue to go elsewhere because other states are offering more money and, in turn, getting Colorado film professionals to move there for more work.

Patrick Hackett, founder and producer of Neon Sheep Pictures, explained that funders of projects look increasingly at what spending offsets states are offering when they are deciding where they want a film to be made. A Denver resident, Hackett would like to make more films in this state, but he needs help in doing so, he said.

“When I’m putting financing together, I have a fiduciary responsibility to my investors to make financially responsible decisions,” he told the Senate committee. “We choose the most fiscally responsible location. Colorado right now is not that, but we could be.”

Herod attributed the significant reduction in funding to politics, saying that some people on both sides of the aisle still don’t like the idea of giving taxpayer money to the film industry.

Existing and potential impact of the film industry

But she pointed to a University of Colorado Leeds School of Business analysis that determined that $30 million in incentives given to 127 projects during the first decade of the incentive led to the hiring of 6,077 cast and crew and generated $330 million in economic impact. And she said that argument is winning over skeptics, citing support from GOP Rep. Ken DeGraaf of Colorado Springs, one of the most fiscally conservative legislators, who on May 8 backed HB 1309 by saying his biggest problem was that it didn’t go far enough to lower state taxes.

Colorado state Rep. Ken DeGraaf discusses his support for a film-tax-credit bill on the House floor.

Polis too extolled the additional incentives in his signing statement, saying that the money will couple with Colorado’s natural endowments to spur additional film production here that will positively feature the Centennial State and will create new jobs. But the Legislature needs to go back early next year and fix the current law so that when the one-year incentive program expires, the Colorado Office of Film Television & Media can continue to offer rebates until a bill-mandated analysis of the new tax credit determines whether it is a better tool.

So, Herod emphasized, HB 1309 is a start from which the local industry can build.

“I believe it provides some level of certainty for people who want to believe in Colorado,” she said. “But it doesn’t provide the long-term certainty we need. Colorado could do so much more, and I look forward to continuing to fight for that.”